Introduction

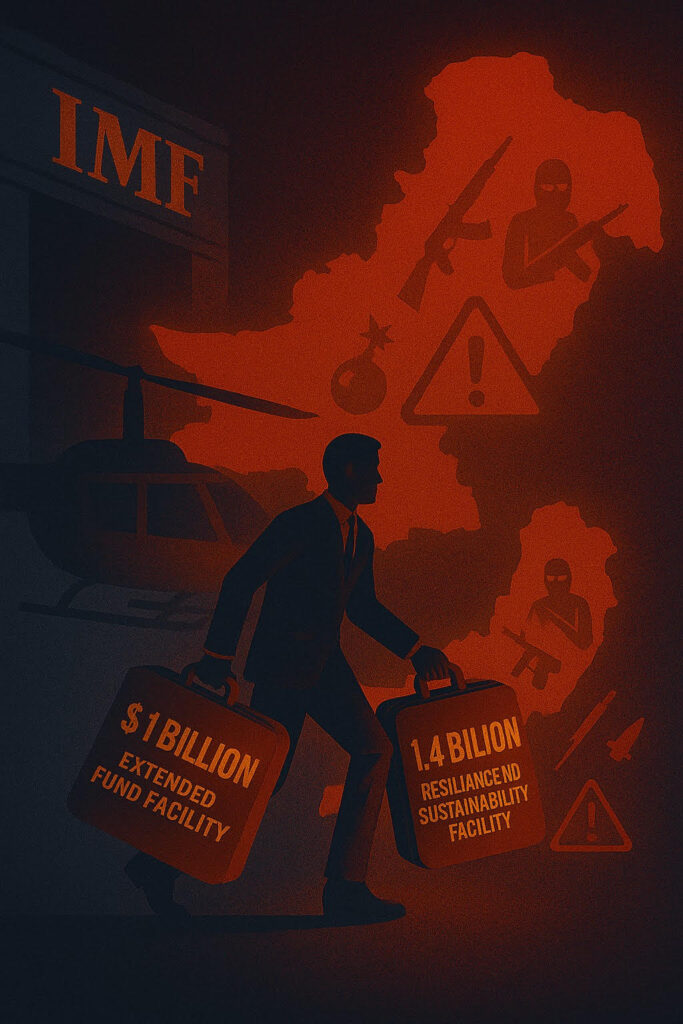

The IMF (International Monetary Fund) in May 2025, approved a $2.3 billion financial package for Pakistan, comprising a $1 billion tranche under the Extended Fund Facility (EFF) and an additional $1.4 billion under the Resilience and Sustainability Facility (RSF). While the IMF hailed the decision as critical to stabilizing Pakistan’s economy, the move has sparked significant legal and diplomatic backlash—most notably from India.

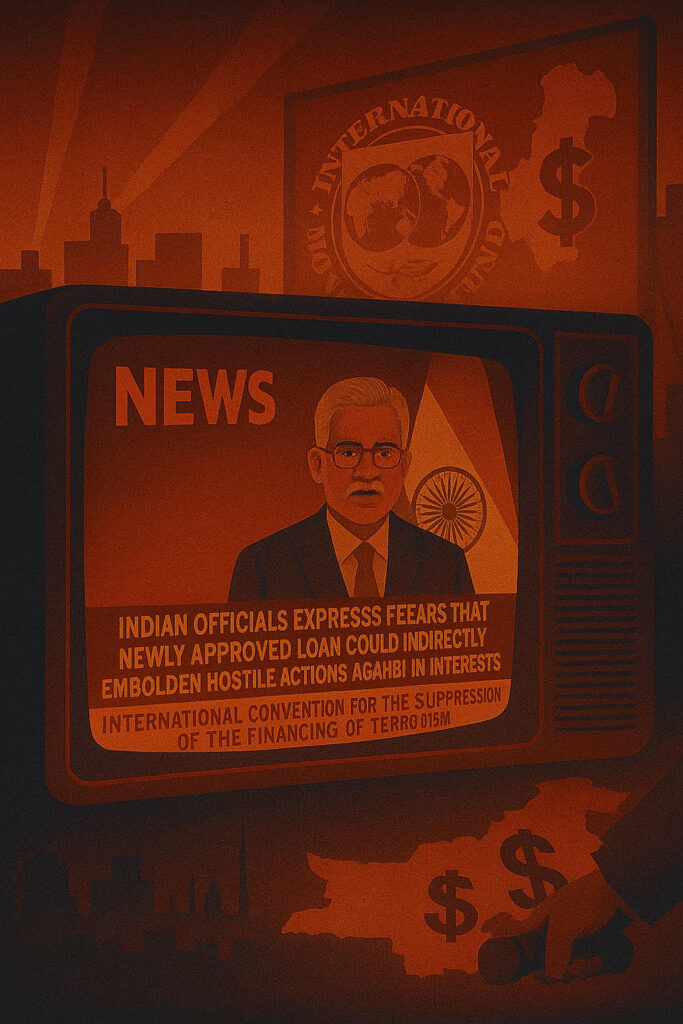

India abstained from the IMF vote, citing concerns over Pakistan’s alleged support for cross-border terrorism and potential misuse of international aid. The development raises pressing questions: Can international financial institutions extend aid to states facing terrorism allegations without violating global legal standards? What mechanisms exist to ensure accountability, and is the current framework sufficient?

This blog examines these issues through a legal lens—exploring IMF responsibilities, counter-terrorism conventions, India’s protest, and broader implications for global governance.

Understanding IMF’s Lending Framework

The IMF provides financial assistance to countries facing macroeconomic instability, primarily through programs like the:

- Extended Fund Facility (EFF): Designed to assist countries with balance-of-payment challenges, typically involving structural reforms and policy conditions.

- Resilience and Sustainability Facility (RSF): A newer tool to address long-term threats such as climate change, pandemic preparedness, and systemic risks to economic stability.

While the intent behind such facilities is developmental, their implementation cannot be divorced from international legal responsibilities. Article I of the IMF’s Articles of Agreement stresses the importance of maintaining global financial confidence—something that could be jeopardized if funds are diverted to illicit or destabilizing ends.

That said, the IMF lacks a formal mandate to assess terrorism-related risks. Its current oversight mechanisms rely heavily on data from the borrowing state and internal financial controls, which may not be adequate in politically sensitive contexts like Pakistan.

Legal and Ethical Implications of Funding States with Terrorism Allegations

International financial institutions, though apolitical by design, operate within a legal framework that intersects with global security obligations. Chief among these is the International Convention for the Suppression of the Financing of Terrorism (1999), which prohibits the direct or indirect provision of funds intended for use in terrorist acts. Additionally, UN Security Council Resolutions 1373 (2001) and 2462 (2019) urge states to strengthen measures to combat terrorism financing—including financial oversight and due diligence.

Although these instruments are primarily directed at states, they indirectly impose responsibilities on institutions like the IMF. Customary international law, especially Article 16 of the ILC’s Articles on State Responsibility, further holds that entities must avoid aiding a state in committing internationally wrongful acts, such as terrorism financing.

Beyond legalities, ethical concerns also loom large. Is it morally justifiable to provide large-scale financial assistance to governments accused of undermining regional peace? While economic aid can support civilian welfare, it must be balanced against the risks of empowering regimes alleged to act outside international norms.

India’s Position and Legal Concerns

India’s abstention from the IMF vote was a calculated diplomatic move, underscoring its longstanding concerns over Pakistan’s alleged misuse of international funds to support cross-border terrorism. Citing Pakistan’s poor track record and the resurgence of militant activity in Kashmir, Indian officials expressed fears that the newly approved loan could indirectly embolden hostile actions against Indian interests.

From a legal standpoint, India’s objection draws strength from the International Convention for the Suppression of the Financing of Terrorism, which obliges state parties and financial institutions to prevent funds from being diverted to terrorist activities. India argues that without robust financial safeguards, the IMF risks breaching the spirit of its obligations under international law. Moreover, the principle of due diligence under customary international law demands that international bodies like the IMF anticipate and mitigate foreseeable harm arising from their actions—particularly in high-risk regions like South Asia.

India’s abstention thus goes beyond political signaling; it highlights a deeper call for institutional accountability and reform in how multilateral lenders evaluate security risks when approving high-stakes loans.

Precedents and Comparative Analysis

This is not the first time international financial assistance has come under scrutiny for potential misuse. In the early 2000s, World Bank funding to Sri Lanka during its civil conflict faced criticism for the lack of safeguards in regions marred by militant activity. More recently, aid to Afghanistan during both pre- and post-Taliban phases revealed significant flaws in oversight, with billions misappropriated due to weak financial monitoring.

These precedents reinforce the need for political risk assessments to accompany financial decisions. While institutions like the IMF are not enforcement agencies, their lending decisions influence global power dynamics. In high-stakes environments, the absence of proper vetting not only risks legal breaches but can also erode institutional legitimacy.

Recommendations for International Financial Institutions

The Pakistan-IMF episode should be a wake-up call for multilateral lenders to strengthen internal checks in geopolitically sensitive loans. First, enhanced due diligence procedures should be mandated for countries identified by the FATF or under scrutiny for terrorism links. These assessments must draw on inputs from intelligence partners, regional stakeholders, and multilateral watchdogs.

Second, disbursements should be phased and conditional, with third-party audit mechanisms to verify end-use. Transparent reporting and external monitoring can prevent misappropriation and rebuild trust in financial interventions.

Finally, institutions must evolve to incorporate legal escalation triggers—where formal objections from member states, like India, result in additional compliance checks. Such reforms would ensure that financial assistance does not inadvertently undermine peace and legal norms.

Conclusion

The IMF’s recent loan to Pakistan is more than an economic intervention; it is a case study in the collision of financial diplomacy, legal obligations, and regional geopolitics. As allegations of terrorism funding persist, the role of institutions like the IMF must be re-examined—not to politicize their mandates, but to align them with global norms of transparency and accountability.

India’s abstention sends a clear message: economic aid must come with legal scrutiny. As the global order becomes more interlinked, multilateral lenders cannot afford to operate in isolation from security and legal realities. It is time to reform the architecture of international finance to reflect not only economic urgency but also ethical responsibility.

References

- IMF Approves Financial Assistance to Pakistan (2025)- Read the official IMF press release

- World Bank’s Aid to Sri Lanka During Civil Conflict (2000–2005)- Access the World Bank report

- World Bank’s Assistance to Afghanistan Post-2002- View the World Bank evaluation

Related Insight

For a broader legal perspective on how international treaties intersect with regional stability and transboundary governance, read our recent analysis of the Indus Waters Treaty—a landmark agreement shaping India-Pakistan water diplomacy.

Contact Us

If you require legal assistance, expert guidance on cross-border compliance, or have any inquiries related to the issues discussed in this article, our team at LexNova Consulting would be happy to help.

For direct queries or to schedule a consultation, please fill out our contact form and a member of our team will get back to you promptly.

Disclamer

This article presents a legal and ethical analysis based on publicly available facts and international developments. It does not make any allegations or assertions against any nation, institution, or entity.